Welcome to DeFi Sunday

DeFi Sunday is your go-to resource for comprehensive information on the latest developments in the world of cryptocurrencies and decentralized finance (DeFi). Whether you’re an investor conducting research, an enthusiast eager to learn more, or simply curious about this fascinating new industry, DeFi Sunday has something for you.

Understanding DeFi: A New Financial Paradigm

Decentralized Finance (DeFi) vs. Centralized Finance

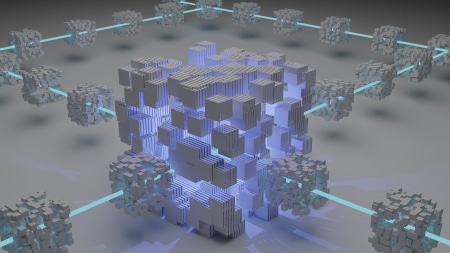

Decentralized finance, often referred to as “DeFi,” represents a significant shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. From lending and borrowing platforms to stablecoins and tokenized Bitcoin (BTC), the DeFi ecosystem has launched an expansive network of integrated protocols and financial instruments.

History of centralized finance

In the early days of finance, all financial activity was centralized. This system worked well when there were only a few players in the market, but as the market grew more complex, centralized finance began to show its limitations. One of the biggest problems with centralized finance is its vulnerability to manipulation and lack of transparency, as seen during the 2008 financial crisis.

How Centralized Finance Works

Most financial systems today are centralized, controlled by a small group of institutions like central banks, commercial banks, and other financial intermediaries. These institutions manage accounts, process payments, and lend money. While centralized finance is designed to be efficient and secure, it also has drawbacks such as high fees, limited choice, and risk of abuse.

Advantages and Disadvantages of Centralized Finance

- Advantages:

- Efficiency: Financial intermediaries can pool resources and offer a wide range of services.

- Security: Institutions like banks are regulated by governments and have strong security systems in place.

- Disadvantages:

- Lack of Transparency: Financial activity is often opaque.

- Limited Choice: Investment options can be restricted.

- High Fees: Financial intermediaries often charge high fees.

- Risk: Centralized systems can be vulnerable to systemic failures.

How Decentralized Finance (DeFi) Works

DeFi refers to the shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. By deploying immutable smart contracts on Ethereum, DeFi developers can launch financial applications and platforms that run exactly as programmed and are available to anyone with an Internet connection.

Benefits of Decentralized Finance

- Transparency and Trust: DeFi offers a new level of transparency and openness in financial transactions.

- Accessibility: DeFi services are available to anyone with an Internet connection, without the need for intermediaries.

- Innovation: DeFi enables novel applications like decentralized exchanges, synthetic assets, and flash loans.

Challenges with DeFi

While DeFi offers many advantages, it also comes with challenges. The ecosystem is still in its early stages, which means constant change and uncertainty. Additionally, DeFi relies heavily on smart contracts, which can introduce risks if they contain errors.

Whereas our traditional financial system runs on centralized infrastructure that is managed by central authorities, institutions, and intermediaries, decentralized finance is powered by code that is running on the decentralized infrastructure of the Ethereum blockchain. By deploying immutable smart contracts on Ethereum, DeFi developers can launch financial protocols and platforms that run exactly as programmed and that are available to anyone with an Internet connection.

The breakthrough of DeFi is that crypto assets can now be put to use in ways not possible with fiat or “real world” assets. Decentralized exchanges, synthetic assets, and flash loans are completely novel applications that can only exist on blockchains. This paradigm shift in financial infrastructure presents a number of

DeFi services are built on top of decentralized networks like Ethereum. These networks use smart contracts to facilitate transactions between users. Smart contracts are self-executing contracts that enforce the terms of an agreement between two parties. In the context of DeFi, smart contracts are used to create financial instruments like loans and mortgages.

Because DeFi services are built on decentralized networks, they are not subject to the same regulations as traditional financial institutions. This means that users can access a wider range of services and products than they would be able to through a traditional bank. It also means that there is no need for intermediaries like brokers or middlemen.

Benefits of decentralized finance

The breakthrough of DeFi is that crypto assets can now be put to use in ways not possible with fiat or “real world” assets. Decentralized exchanges, synthetic assets, and flash loans are completely novel applications that can only exist on blockchains. This paradigm shift in financial infrastructure presents a number of advantages with regard to risk, trust, opportunity, and access.

Risk: In traditional finance, counterparties must trust each other not to default on obligations like loans or derivatives contracts. With DeFi protocols, trustless smart contracts replace counterparty risk with code risk: the risk that a bug in the contract will lead to loss of funds. While code risk is non-trivial,

Challenges with DeFi

DeFi is a relatively new phenomenon in the world of finance. Although it has existed in theory for years, it only began to gain traction in the past few years. DeFi is an umbrella term for a growing ecosystem of financial applications built on Ethereum. These applications aim to provide alternatives to traditional financial products and services, such as lending, borrowing, and trading.

One of the key advantages of DeFi is that it is decentralized, meaning that it is not subject to the same centralized control as traditional finance. This decentralization has a number of benefits, including increased security and transparency. However, it also comes with some challenges.

One challenge with DeFi is that it is still in its early stages of development. This means that there are a lot of rough edges and things are constantly changing. This can make it difficult to use DeFi applications, as users need to be comfortable with constant change and uncertainty. Another challenge is that DeFi relies heavily on smart contracts. While smart contracts can provide a lot of advantages, they also come with their own set of risks. If a smart contract contains errors, it can lead to major problems for the users of that contract.

Conclusion

So, what’s the verdict? Decentralized finance definitely has some advantages over centralized finance. For one thing, it’s much more secure since there’s no central point of failure. Additionally, decentralized finance is often more transparent and trustworthy since there’s no single entity in control. However, centralized finance still has its place — particularly when it comes to speed and convenience. In the end, it’s up to you to decide which type of financial system you want to use.

What are the Key Benefits of DeFi Over Traditional Finance

Decentralized Finance (DeFi) offers several key benefits over traditional finance (TradFi), which are transforming the financial landscape. Here are the primary advantages:

1. Accessibility and Financial Inclusion

DeFi provides financial services to anyone with an internet connection, removing barriers such as geographic location and exclusionary practices often seen in traditional banking systems. This democratization of finance allows individuals who are unbanked or underbanked to access financial products and services, potentially improving economic opportunities and financial security for an estimated 1.7 billion adults globally who do not have access to a bank account.

2. Reduced Costs and Increased Efficiency

By eliminating intermediaries such as banks and brokers, DeFi significantly reduces transaction costs and increases efficiency. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, facilitate transactions without the need for a central authority, leading to lower fees and faster processing times.

3. Transparency and Trust

DeFi transactions are recorded on blockchain technology, ensuring a high level of transparency and auditability. This transparency reduces the risk of fraud and corruption, as all transactions can be publicly verified. Users have full control over their assets and personal information, unlike in traditional financial systems where banks and other institutions hold and control user data.

4. Security and Privacy

DeFi platforms offer enhanced security and privacy compared to traditional finance. Since transactions are peer-to-peer and facilitated by smart contracts, users maintain control over their assets and personal information. The decentralized nature of DeFi reduces the risk of a single point of failure, which is a common vulnerability in centralized systems.

5. Innovation and Programmability

DeFi enables rapid innovation and the creation of new financial products and services. The open-source nature of DeFi platforms allows developers to build and deploy applications quickly, fostering a vibrant ecosystem of financial tools. Smart contracts enable programmable money, automating financial transactions and offering new levels of convenience and functionality.

6. Global Accessibility and 24/7 Operation

DeFi operates around the clock and is accessible from anywhere in the world, providing continuous access to financial services. This is particularly beneficial for cross-border transactions, which can be slow and expensive in traditional banking systems.

7. Interoperability

DeFi platforms are designed to be interoperable, meaning they can work seamlessly with other DeFi platforms and traditional financial systems. This interoperability enhances the overall functionality and user experience, allowing for more integrated and comprehensive financial services.

8. Lower Barriers to Entry

DeFi lowers the barriers to entry for creating and offering financial instruments. Unlike traditional finance, which requires compliance with numerous regulations and significant capital, DeFi allows anyone to participate and innovate, fostering a more inclusive financial ecosystem.

While DeFi offers numerous advantages over traditional finance, it is important to note that it also comes with challenges such as security risks, regulatory uncertainty, and market volatility. However, the potential benefits of increased accessibility, reduced costs, transparency, and innovation make DeFi a compelling alternative to traditional financial systems.By leveraging these benefits, DeFi has the potential to revolutionize the financial industry, providing more inclusive and efficient financial services on a global scale.

Successful DeFi Projects and Their Benefits

Decentralized Finance (DeFi) has seen a surge in innovative projects that leverage blockchain technology to offer financial services without intermediaries. Here are some of the most successful DeFi projects and their benefits:

1. Ethereum (ETH)

Benefits:

- Foundation for DeFi: Ethereum is the primary blockchain for most DeFi applications, providing the infrastructure for smart contracts and decentralized applications (dApps).

- Smart Contracts: Enables the creation of complex financial products without intermediaries.

- Scalability Upgrades: Upcoming upgrades like “proof-of-stake” aim to improve transaction speed, reduce costs, and enhance energy efficiency

2. Uniswap (UNI)

Benefits:

- Decentralized Exchange (DEX): Allows users to trade cryptocurrencies directly without intermediaries.

- Liquidity Pools: Users can provide liquidity and earn fees, promoting a decentralized trading environment.

- Governance: UNI token holders can vote on protocol changes, enhancing community involvement

3. Compound (COMP)

Benefits:

- Lending and Borrowing: Users can lend their crypto assets to earn interest or borrow against their holdings.

- Algorithmic Interest Rates: Interest rates are set algorithmically based on supply and demand, ensuring market efficiency.

- Governance: COMP token holders can participate in governance decisions, influencing the platform’s future

4. Curve Finance (CRV)

Benefits:

- Stablecoin Exchange: Specializes in low-slippage swaps between stablecoins and other pegged assets.

- Liquidity Pools: Users can earn fees by providing liquidity, with minimal impermanent loss due to the stable nature of the assets.

- Composability: Integrates with other DeFi protocols, enhancing the overall ecosystem

5. Aave (AAVE)

Benefits:

- Lending and Borrowing: Offers a wide range of crypto assets for lending and borrowing.

- Flash Loans: Allows users to borrow instantly and repay within the same transaction, enabling arbitrage opportunities.

- Governance: AAVE token holders can vote on protocol changes, ensuring decentralized control

6. MakerDAO (MKR)

Benefits:

- Stablecoin (DAI): Issues DAI, a decentralized stablecoin pegged to the US dollar, backed by collateralized debt positions.

- Decentralized Governance: MKR token holders govern the protocol, making decisions on risk parameters and collateral types.

- Financial Inclusion: Provides a stable and decentralized currency option, especially useful in regions with volatile local currencies

7. Yearn Finance (YFI)

Benefits:

- Yield Aggregation: Optimizes yield farming strategies across various DeFi protocols to maximize returns.

- Automated Strategies: Simplifies the process of earning yield, making it accessible to average users.

- Governance: YFI token holders can vote on protocol changes, ensuring community-driven development.

8. Convex Finance (CVX)

Benefits:

- Boosted Rewards: Enhances rewards for liquidity providers on Curve Finance by pooling voting power and incentives.

- Automated Compounding: Automates the process of claiming and compounding rewards, maximizing user returns.

- Governance: CVX token holders can participate in governance, influencing the platform’s direction.

These DeFi projects exemplify the transformative potential of decentralized finance by offering innovative financial services that are more accessible, transparent, and efficient than traditional systems. By leveraging blockchain technology and smart contracts, these projects provide users with new opportunities for earning, borrowing, and trading, all while maintaining control over their assets and data.

Here are some of the top DeFi projects:

1. Ethereum (ETH)

Overview:

- Ethereum is the foundational blockchain for most DeFi applications, supporting a wide range of decentralized apps (dApps) and smart contracts.

- It processes over 1 million transactions per day, indicating high user activity and adoption.

2. Uniswap (UNI)

Overview:

- Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly without intermediaries.

- It has a significant user base due to its ease of use and liquidity pools, making it one of the most popular DEXs.

3. Aave (AAVE)

Overview:

- Aave is a lending and borrowing protocol that allows users to earn interest on deposits and borrow assets.

- It supports multiple chains and has a high total value locked (TVL), indicating strong user adoption.

4. Compound (COMP)

Overview:

- Compound is another leading lending and borrowing protocol on Ethereum.

- It dynamically adjusts interest rates based on supply and demand, attracting a large number of users.

5. Curve Finance (CRV)

Overview:

- Curve Finance specializes in low-slippage swaps between stablecoins and other pegged assets.

- Its focus on stablecoins and integration with other DeFi protocols has led to high user adoption.

6. GoodGhosting

Overview:

- GoodGhosting is a DeFi social savings app that gamifies savings to encourage better financial habits.

- It is particularly popular in developing countries where traditional banking access is limited but mobile and internet access is high.

7. Sending.Me

Overview:

- Sending.Me is a decentralized group chat platform that integrates DeFi functionalities like P2P swaps, community marketplaces, and token-gated memberships.

- It aims to provide a user-friendly social platform for Web3 activities, attracting a diverse user base.

8. Osmosis

Overview:

- Osmosis is a user-friendly DEX on the Cosmos network, known for its straightforward interface and strong community support.

- It is highly recommended for new users due to its simplicity and ease of use.

9. Yearn Finance (YFI)

Overview:

- Yearn Finance optimizes yield farming strategies across various DeFi protocols to maximize returns.

- Its automated strategies and user-friendly interface have attracted a significant number of users.

10. Hop Protocol

Overview:

- Hop Protocol is known for having one of the lowest prices per user among DeFi projects, making it accessible and attractive to a broad user base.

Conclusion

These projects are leading in terms of user adoption due to their innovative features, user-friendly interfaces, and the ability to meet various financial needs without intermediaries. Ethereum remains the bedrock of DeFi, supporting a vast ecosystem of applications that drive user engagement and adoption.

Todays Featured Product:

Buy, exchange and grow your crypto securely with a Ledger hardware wallet, combined with the Ledger Live app. It’s never been easier to keep your crypto safe and accessible. Buy direct from Ledger.com and get todays Special Offers Here.