The Dark Side of DeFi: Risks and How to Mitigate Them

The Dark Side of DeFi: Risks and How to Mitigate Them

Understanding the Wild West: A Look Into the Risks of Decentralized Finance

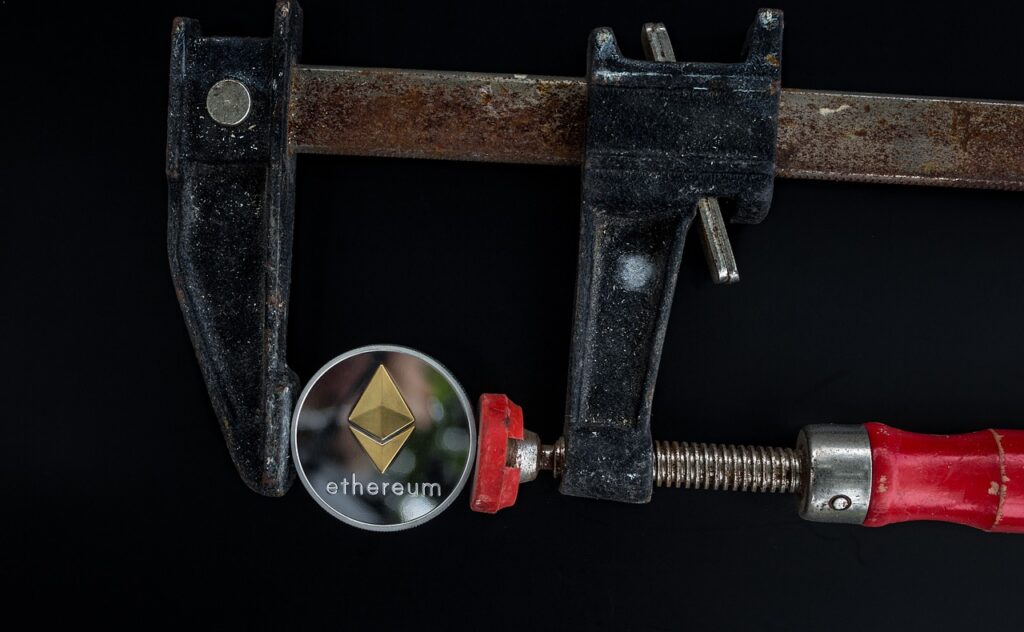

Decentralized Finance, or DeFi for short, has emerged as a revolutionary concept in the world of financial services. It offers individuals the opportunity to engage in various financial activities without the need for intermediaries like banks or traditional financial institutions. However, with great potential comes great risk, and DeFi is no exception.

One of the most prominent risks associated with DeFi is the lack of regulatory oversight. Unlike traditional financial systems, DeFi platforms operate in a decentralized manner, which means that there is no central authority or governing body monitoring their activities. While this provides individuals with greater control over their finances, it also exposes them to potential scams, frauds, and security vulnerabilities.

Navigating the Risky Waters: Common Pitfalls to Watch out for in DeFi

DeFi, short for decentralized finance, has gained significant attention in recent years as a new and promising alternative to traditional financial systems. With the promise of decentralization, autonomy, and transparency, many individuals are eager to jump into the world of DeFi to capitalize on its potential benefits. However, it is crucial to navigate these waters with caution, as there are common pitfalls that can catch even the most experienced participants off guard.

One common pitfall in DeFi is the risk of smart contract vulnerabilities. Smart contracts, which are self-executing agreements written in code, form the backbone of many DeFi platforms. However, these contracts are not immune to flaws, and a single vulnerability can lead to devastating consequences. From coding mistakes to malicious exploits, the risks associated with smart contracts cannot be overlooked. It is essential for potential DeFi participants to thoroughly assess and conduct due diligence on the platforms they choose to engage with, including auditing the smart contracts to ensure their security and reliability.

The Hacking Menace: How Cybercriminals Exploit Vulnerabilities in DeFi Platforms

In the fast-evolving world of decentralized finance (DeFi), cybercriminals have found new hunting grounds to exploit vulnerabilities and prey on unsuspecting investors. With the promise of high and quick returns, DeFi platforms have become lucrative targets for hackers seeking to make a quick profit. These cybercriminals employ various techniques to breach the security of DeFi platforms and manipulate the system to their advantage.

One of the most common ways cybercriminals exploit vulnerabilities in DeFi platforms is through smart contract attacks. Smart contracts are pieces of code that execute predefined actions when certain conditions are met. However, if these contracts have flaws or are poorly written, hackers can exploit these weaknesses to manipulate the contract’s functionality, resulting in significant financial losses for users. Additionally, hackers also target centralized components of DeFi platforms, such as centralized exchanges or wallets, which often serve as entry points for infiltrating the system. The decentralized nature of DeFi platforms makes it difficult to trace and recover stolen funds, making them prime targets for cybercriminals looking to make quick getaways.

The Unregulated Realm: Assessing the Lack of Oversight in Decentralized Finance

The world of decentralized finance (DeFi) operates in a unique and unregulated realm, free from the constraints and oversight of traditional financial systems. This lack of regulation, while exciting for proponents of DeFi, also opens the door to potential risks and vulnerabilities. Without a central authority to ensure compliance and protect investors, participants in DeFi must be vigilant and take responsibility for evaluating the inherent risks associated with these platforms.

One of the most significant concerns in the unregulated realm of DeFi is the potential for fraudulent projects to emerge and deceive unsuspecting investors. With little to no oversight, scammers can easily create fake projects, attract investors, and disappear with their funds. This phenomenon, known as “rug pulling,” highlights the importance of conducting thorough research and due diligence before engaging with any DeFi project. By investigating the team behind a project, assessing its credibility, and seeking validation from trusted sources, investors can minimize their exposure to potential scams in the unregulated realm.

Smart Contract Risks: Unveiling the Vulnerabilities That Can Lead to Costly Losses

Smart contracts have revolutionized the world of decentralized finance, enabling automated and trustless transactions. However, these innovative codes are not without risks. One of the main vulnerabilities lies in the possibility of bugs or coding errors that can lead to costly losses for users. In simple terms, a single mistake within the smart contract’s code can have disastrous consequences.

Just like any software, smart contracts are susceptible to human error. Even the smallest glitch in the code can be exploited by attackers to siphon off funds or manipulate the contract’s behavior. The decentralized nature of these contracts means that once deployed, they cannot be altered or corrected, making it crucial to thoroughly audit and test them before implementing. Without careful scrutiny, a simple oversight could result in irreversible financial damages. As the use of smart contracts continues to grow in decentralized finance, it becomes increasingly important for users to be aware of these risks and take appropriate measures to protect themselves.

The Rug Pull Phenomenon: How Fraudulent Projects Deceive and Steal from Investors

Investors in the world of decentralized finance (DeFi) must always be on the lookout for the rug pull phenomenon. This shady behavior occurs when fraudulent projects deceive unsuspecting investors and vanish with their funds. Rug pulls often happen when a project gains popularity and attracts substantial investments. Once the project creator feels they have collected enough funds, they suddenly pull the rug out from under the investors, leaving them high and dry with empty pockets.

The rug pull phenomenon works by exploiting the trust and eagerness of investors. Fraudulent projects use various tactics to gain credibility and attract a large following. They may promise high returns or showcase partnerships with well-known individuals or companies. However, once these projects have amassed a significant amount of funds, they disappear into thin air, leaving investors shocked and devastated. It is important for investors to exercise caution, conduct thorough research, and be skeptical of any project that appears too good to be true.

Flash Loan Attacks: Analyzing the Exploits That Target DeFi Protocols

Flash loan attacks have become a prominent concern within the decentralized finance (DeFi) space. These types of attacks exploit the unique features of DeFi protocols, particularly the ability to execute complex transactions within a single block on the blockchain. In a flash loan attack, a malicious actor takes advantage of the temporary loan functionality offered by DeFi protocols to borrow a large sum of assets without collateral. They then use these borrowed funds to manipulate the market, exploit price discrepancies, or carry out other nefarious activities.

One of the main reasons why flash loan attacks are particularly concerning is their ability to cause significant disruptions in the DeFi ecosystem. Unlike traditional financial systems, where loans are typically collateralized and subject to credit checks, flash loans require no upfront collateral. This lack of collateral makes it easier for attackers to carry out large-scale market manipulations or exploit vulnerabilities in smart contracts. These attacks not only pose a risk to individual users but also undermine the overall trust and stability of the DeFi space. As the popularity of DeFi continues to rise, it is crucial for users and developers to remain vigilant and implement robust security measures to protect against flash loan attacks.

Impermanent Loss: Understanding the Potential Drawbacks of Liquidity Provision

As an investor in decentralized finance (DeFi), one potential drawback to be aware of is impermanent loss when providing liquidity. Impermanent loss occurs when the value of the assets you provide as liquidity changes in relation to each other. This can happen due to price fluctuations or volatility in the market.

Let’s say you decide to contribute equal amounts of Ether (ETH) and a token called DeFiCoin (DFC) to a liquidity pool. If the price of DFC increases while the price of ETH remains stable, you may experience impermanent loss. As more traders buy DFC, the pool’s automated system may adjust the prices, causing your ETH holdings to decrease in value. Essentially, the profit you could have made by simply holding onto your ETH may be diminished because of impermanent loss.

It’s important to understand that impermanent loss is not an immediate loss of funds, but rather a potential loss that depends on the market dynamics. Monitoring the market closely and considering the potential risks associated with liquidity provision can help you make more informed decisions.

Mitigating Risks: Strategies and Best Practices for Safely Participating in DeFi

When it comes to participating in decentralized finance (DeFi), it is crucial to have a clear understanding of the risks involved and to adopt effective strategies and best practices for mitigating these risks. One of the fundamental strategies is to conduct thorough research and due diligence before engaging with any DeFi project or platform. This involves carefully examining the project’s whitepaper, team background, and community feedback to ensure legitimacy and minimize the chances of falling victim to fraudulent schemes.

Another important practice is diversification.

Protecting Your Assets: Tools and Measures to Securely Navigate the Dark Side of DeFi

Decentralized Finance (DeFi) has emerged as a thrilling and potentially lucrative sector within the blockchain ecosystem. However, like any disruptive innovation, it comes with its fair share of risks and uncertainties. As investors and participants dive into the world of DeFi, they must arm themselves with tools and measures to protect their assets from the dark side of this unregulated realm.

First and foremost, securing your private keys is of paramount importance. In DeFi, you are your own bank, which means you have full control over your funds. However, this also means that if you lose access to your private keys, you may lose your assets forever. Therefore, it is crucial to store your keys in a secure manner, such as offline hardware wallets, to minimize the risk of theft or loss. Additionally, enabling multi-factor authentication and regularly updating your passwords and recovery phrases can provide an extra layer of security. By taking these simple yet effective precautions, you can safeguard your assets and navigate the dark side of DeFi with confidence.

What is DeFi?

DeFi stands for Decentralized Finance, which refers to a financial system built on blockchain technology that aims to provide financial services without intermediaries like banks.

Why is DeFi considered the “Wild West”?

DeFi is often referred to as the “Wild West” because it operates in a highly unregulated and experimental environment, where risks and opportunities abound.

What are the common pitfalls to watch out for in DeFi?

Some common pitfalls in DeFi include smart contract risks, rug pulls (fraudulent projects), flash loan attacks, and impermanent loss when providing liquidity.

How do cybercriminals exploit vulnerabilities in DeFi platforms?

Cybercriminals exploit vulnerabilities in DeFi platforms by hacking into smart contracts, manipulating prices, conducting flash loan attacks, or creating fraudulent projects to deceive and steal from investors.

Why is there a lack of oversight in decentralized finance?

Decentralized finance operates outside traditional regulatory frameworks, which means there is no centralized authority overseeing its operations. This lack of oversight raises concerns about security and investor protection.

What are smart contract risks in DeFi?

Smart contract risks refer to vulnerabilities in the code of smart contracts used in DeFi platforms. These vulnerabilities can be exploited by hackers to steal funds or manipulate transactions.

What is the “rug pull” phenomenon in DeFi?

The “rug pull” phenomenon refers to fraudulent projects in DeFi that attract investors, then suddenly vanish with their funds, leaving investors with significant losses.

How do flash loan attacks target DeFi protocols?

Flash loan attacks involve taking advantage of the ability to borrow and repay funds within a single transaction in DeFi.

What is impermanent loss in liquidity provision?

Impermanent loss occurs when providing liquidity in DeFi platforms. It refers to the potential loss of value compared to simply holding the assets, caused by price fluctuations during the liquidity provision period.

How can I mitigate risks when participating in DeFi?

To mitigate risks in DeFi, you should conduct thorough research, only invest what you can afford to lose, use reputable platforms, diversify your investments, and stay updated on the latest security practices.

What tools and measures can I use to securely navigate DeFi?

Some tools and measures to securely navigate DeFi include using hardware wallets, utilizing multi-factor authentication, practicing good password hygiene, and being cautious of suspicious links or requests.

Todays Featured Product:

Buy, exchange and grow your crypto securely with a Ledger hardware wallet, combined with the Ledger Live app. It’s never been easier to keep your crypto safe and accessible. Buy direct from Ledger.com and get todays Special Offers Here.